Finnish society is, by international standards, exceptionally transparent and egalitarian. Public data on societal decision-making is openly available. Presenting that data to the broader public in a clear, accessible form, however, still leaves much to be desired.

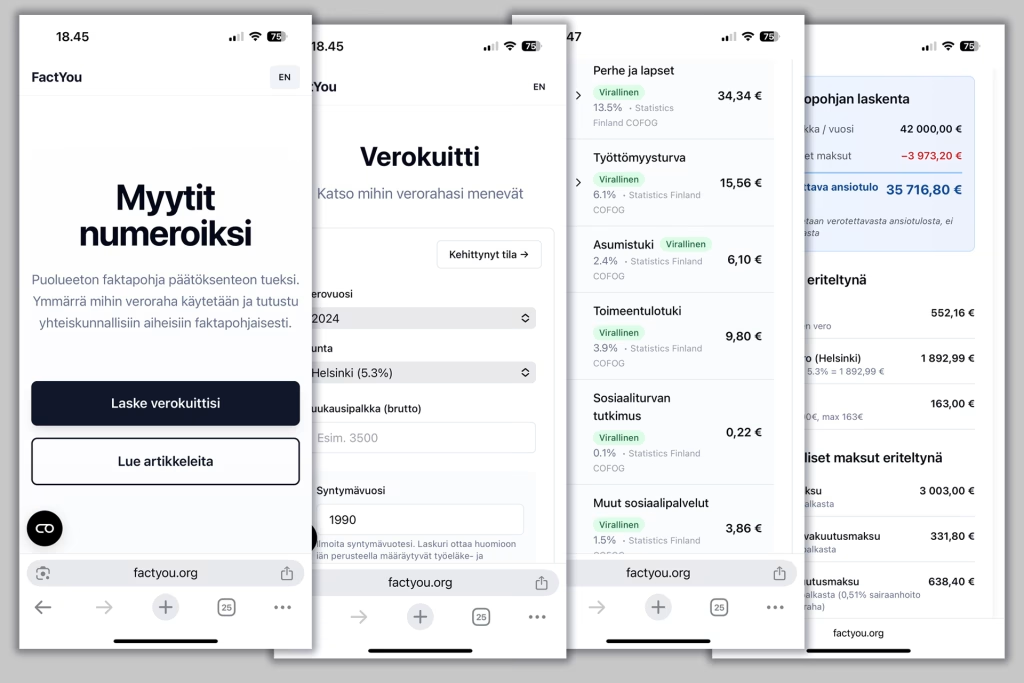

This is the insight that caught the attention of Sparehead Oy, a startup based in Helsinki. The company recently released a “tax receipt” service that shows users exactly where their income tax payments go.

We called the company’s co-founder Timo Mäkinen and asked where the idea came from.

“We built the service because we could,” Mäkinen says. “FactYou provides impartial, fact-based information about society and its financing. Our goal is to make complex information easy for everyone to understand.”

It sounds like a sales pitch. Why would an ordinary taxpayer care about the service for more than a single visit?

“We’re especially interested in topics that tend to pick up populist tones in public debate. Taxation and public financing are examples of those. And since they interest us, it’s entirely possible they interest others too. Our tax-receipt service focuses on income taxation. Consumption taxes operate with a different logic and are just as important. To help make those more concrete, we’re currently developing a gamified tool.”

Intriguing. But how does this tie into populism?

“In Finland, power belongs to the people. FactYou.org gives voters tools for understanding. And that helps them use their power more wisely.”

But voters use their power in elections — and the next elections are still some distance away…

Mäkinen disagrees. “The parliamentary elections are actually not that far off, and when they arrive, the air will again be thick with competing campaign promises. They’re based on values and ideas — as they should be.

The voter’s challenge is figuring out which promises are not only appealing but also credible — in other words, realistically achievable. It helps to have at least a rough sense of how the machinery of public financing works: who pays, what they pay, how much they pay, and what the consequences are — both for the taxpayer and for other Finns.”